MSME Grant 2026

Services

Mobile App Custom mobile apps, built smart.

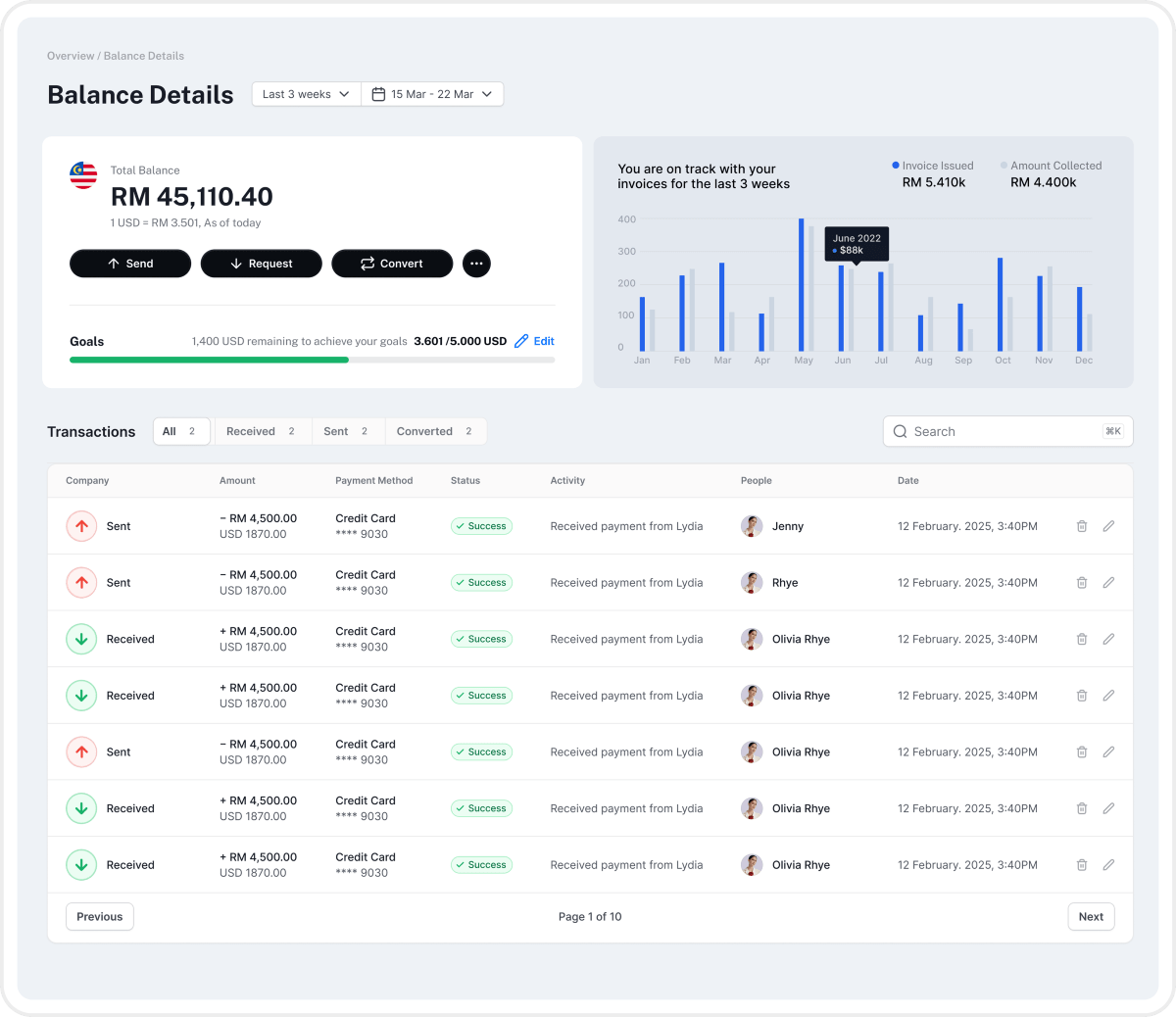

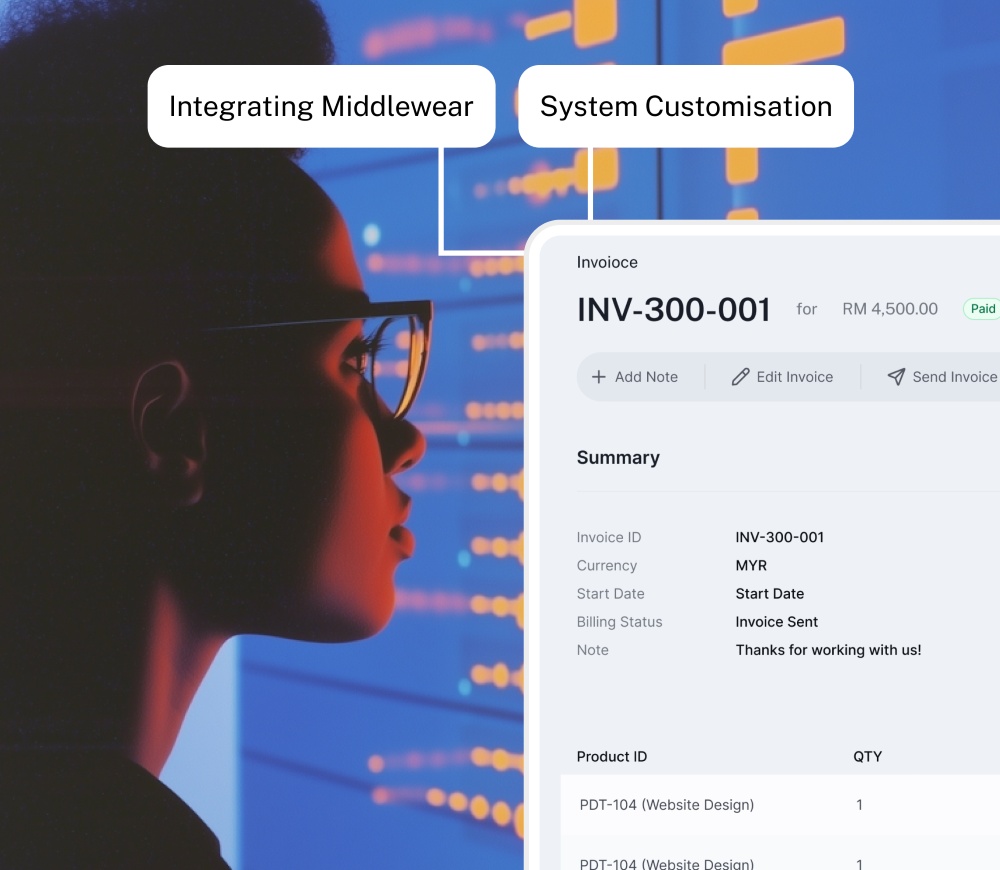

Software Automate tasks, simplify work, grow faster.

Software

Solutions

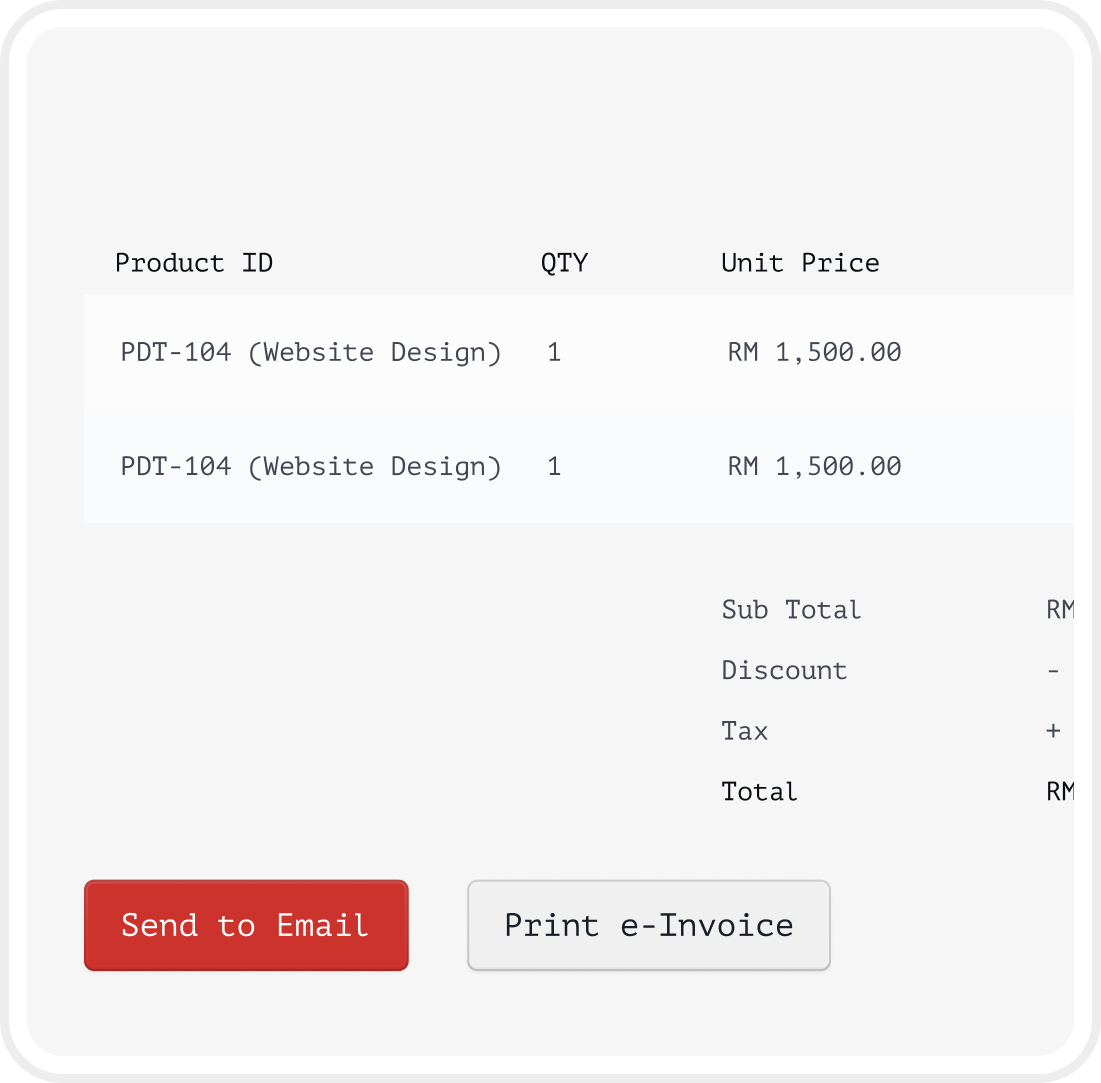

Web & Ecommerce Automate tasks, simplify work, grow faster.

Web Design

E-Commerce

Cybersecurity Automate tasks, simplify work, grow faster.

Security Solutions

Marketing Get noticed, get leads, get growing.

Writing

Video Animation

Branding & Design

SEO & SEM Get noticed, get leads, get growing.

Organic Marketing

Paid Marketing